Overview of Remarkable Lives and Unexpected Farewells

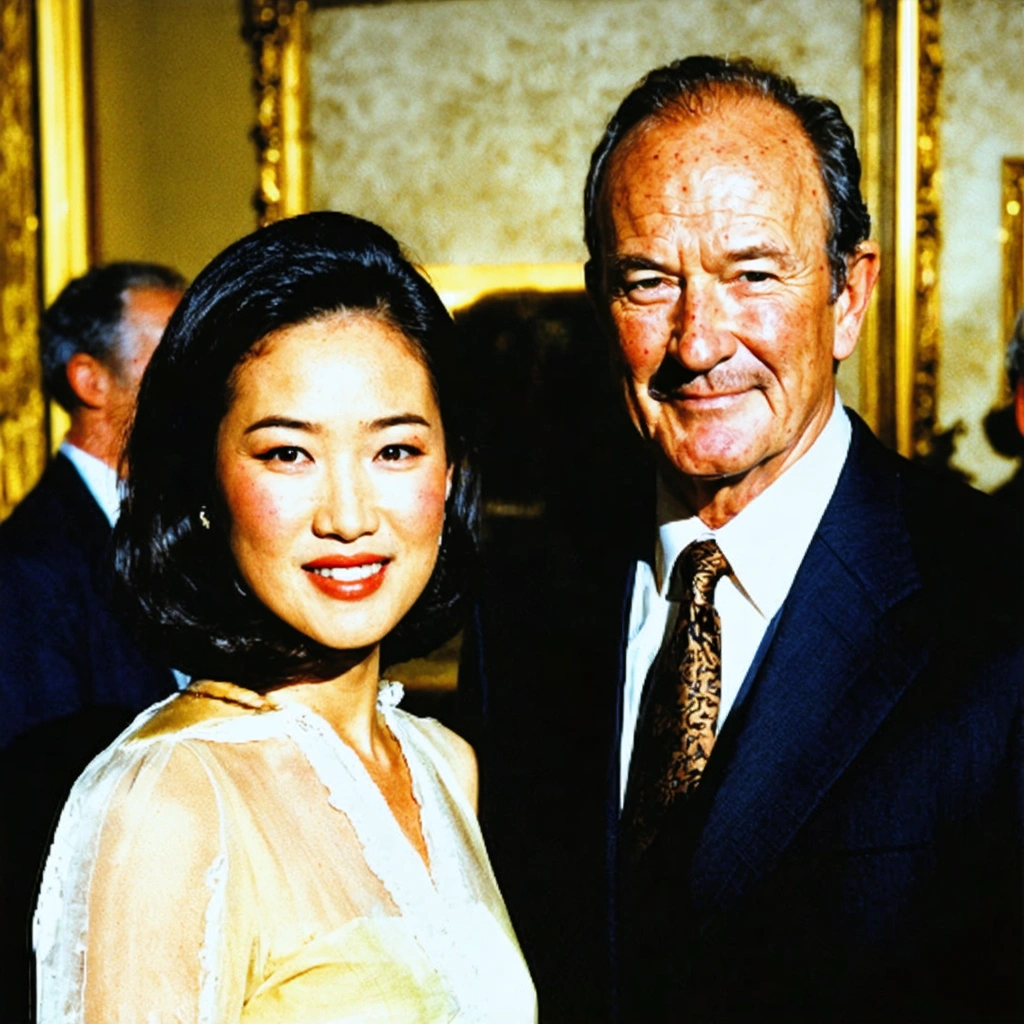

The recent news regarding the natural passing of actor Gene Hackman and his wife, Betsy Arakawa, serves as both a moment of reflection and a call to analyze the enduring impact of their lives on the film industry and its related business environments. Reports indicate that the celebrated actor, who was 95 years old and suffering from Alzheimer’s, may well have been unaware of his beloved wife’s death due to the progression of his condition. This unusual overlap—passing within one week of each other—has sparked a broad discussion not only about their personal legacies but also about the intersection between personal health, public perception, and corporate strategy in managing celebrity estates.

Business and Cultural Implications

Legacy and Industry Impact

Gene Hackman is widely recognized for his versatile roles and profound influence on cinema. His contributions have provided robust content that continues to affect box office revenues, licensing, and subsequent cultural projects. His career is a textbook case of how enduring talent can create long-term revenue streams and brand equity, even when personal health challenges arise later in life. Betsy Arakawa, while less publicly known, had a significant role as a supportive partner whose resilience contributed to the maintenance of this legacy. The timing of their departures forces industry experts, corporate stakeholders, and estate planners to evaluate the following key areas:

- Cultural Capital: The accumulated goodwill and brand identity attached to a name like Gene Hackman serve as major intangible assets for film studios and investors.

- Risk Management: Overlapping personal tragedies offer complex scenarios requiring sensitive handling by public relations teams and corporate governance experts.

- Legacy Continuity: Ensuring that the contributions of personalities like Hackman are preserved and leveraged correctly for future projects and brand positioning.

Corporate Strategy and Investor Considerations

In a business context, the entwined fates of a public figure and his spouse can influence the strategies adopted by media conglomerates and talent management firms. The potential unawareness of his wife’s death due to his Alzheimer’s condition signals a need for reassessing how personal health factors are integrated into risk evaluations for long-term contractual and legacy planning. Corporate analysts and investor relations experts should consider:

- Asset Valuation: Understanding how personal legacies become corporate assets, especially when unpredictable events affect public perceptions.

- Succession Planning: The importance of a clear, strategic succession plan that honors personal histories while ensuring the continued development of intellectual property.

- Stakeholder Communication: Transparent and empathetic communication strategies that balance personal tragedy with corporate interests to maintain investor confidence.

Timeline and Detailed Analysis

Below is a table summarizing key details about the events and their broader implications:

| Aspect | Gene Hackman | Betsy Arakawa |

|---|---|---|

| Age at Time of Death | 95 | Not publicly detailed |

| Cause of Death | Natural causes (complicated by Alzheimer’s) | Natural causes |

| Public Impact | Long-standing film legacy, numerous accolades | Respected partner and supporter |

| Implications for Business | Asset valuation, brand continuity, risk management in intellectual property | Influence on stakeholder sentiment and legacy management |

Looking Ahead: Strategic Responses and Future Directions

Integrating Legacy into Future Business Models

In the aftermath of these developments, stakeholders from various sectors must deliberate on how best to leverage the legacy of two intertwined lives. The following strategies can serve as core guidelines for managing similar scenarios in the future:

- Comprehensive Risk Review: Conduct detailed reviews of how personal health factors and unpredictable life events may affect strategic business assets.

- Enhanced Communication Protocols: Develop robust PR strategies that are empathetic yet informative to manage investor and public expectations during periods of transition.

- Legacy-Driven Innovation: Utilize the enduring brand of celebrated personalities to foster new projects in film, media, and even digital content delivery models, ensuring that their contributions continue to generate value.

Reflections on Corporate Governance and Estate Management

The intertwined nature of fame, personal experience, and business continuity demands an adaptive approach to corporate governance. Companies within the entertainment and media industries must tread carefully, balancing personal respect with the pressures of market dynamics. Estate management specialists should consider integrating modern technology and advisory services to create a more resilient framework that honors personal contributions while also safeguarding corporate investments. This incident offers a crucial lesson: as personal stories become corporate narratives, a seamless integration of empathy, transparency, and strategic foresight becomes paramount.

In conclusion, the passing of Gene Hackman and Betsy Arakawa within such a narrow timeframe underpins a broader reflection on how personal legacies are enmeshed with corporate interests. The lessons gleaned extend from asset management and corporate planning to public relations and legacy preservation, making this a pivotal case study for business leaders and cultural historians alike.